Stock Market of Fear

In the beginning of the pandemic, fear was the emotion which investors most commonly struggled with. Scientists from the NCU analysed hundreds of thousands of posts published on Tweeter in March 2020 and investigated the market players' reactions to coronavirus.

The COVID-19 pandemic was at first perceived as the black swan, i.e. the event that could be compared to nothing else. Dr hab. Tomasz Kruszewski, Prof. NCU from the Department of Cognitive Science at the Faculty of Philosophy and Social Sciences and mgr Joanna Michalak from the Department of Economics at the Faculty of Economic Sciences and Management applied mathematical methods to calculate reactions. Next, they supplemented their results with a psychological analysis and established the emotions perceptible in posts. They discussed the conclusions in a book entitled "Investors reaction to pandemic. Big data analysis of tweets in case of uncertainty".

Fear

In the initial stage of the research, the key words were found and the hashtags which investors used in their tweets were selected. First on the list there were comments with #stock market, supplied with #covid and #coronavirus. “Thus, a collection of data related directly to both the pandemic and stock market was compiled" says mgr Michalak. “There was about a million of them a day, which much exceeded our processing capabilities. After combining the 'pandemic' and 'stock market' entries in a search engine, their number decreased to around 200 000 a day."

The use of quantitative methods is nonobvious and rare in contemporary social sciences because devices able to process such amount of data are scarcely available - explains Prof. Kruszewski.

“The next step involves the text structure analysis. The text needs to be devoid of the so-called unnecessary noise: Twitter tags such as a user name, hashtags, and words most frequently occurring in a given language since they are of no importance to a researcher. A mathematical function compares the remaining text with a dictionary including information about a word, its affect and intensity Then, we used popular dictionaries to analyze the text sentiment," explains mgr Michalak. “They were extended by many researchers who asked people how they understood words, about their feelings and associations the words brought to them. One of such resources is the so-called NCR dictionary containing a list of emotions which Paul Ekman proposed in his theory. Finally, we divided our collection of tweets into subcategories based on emotions."

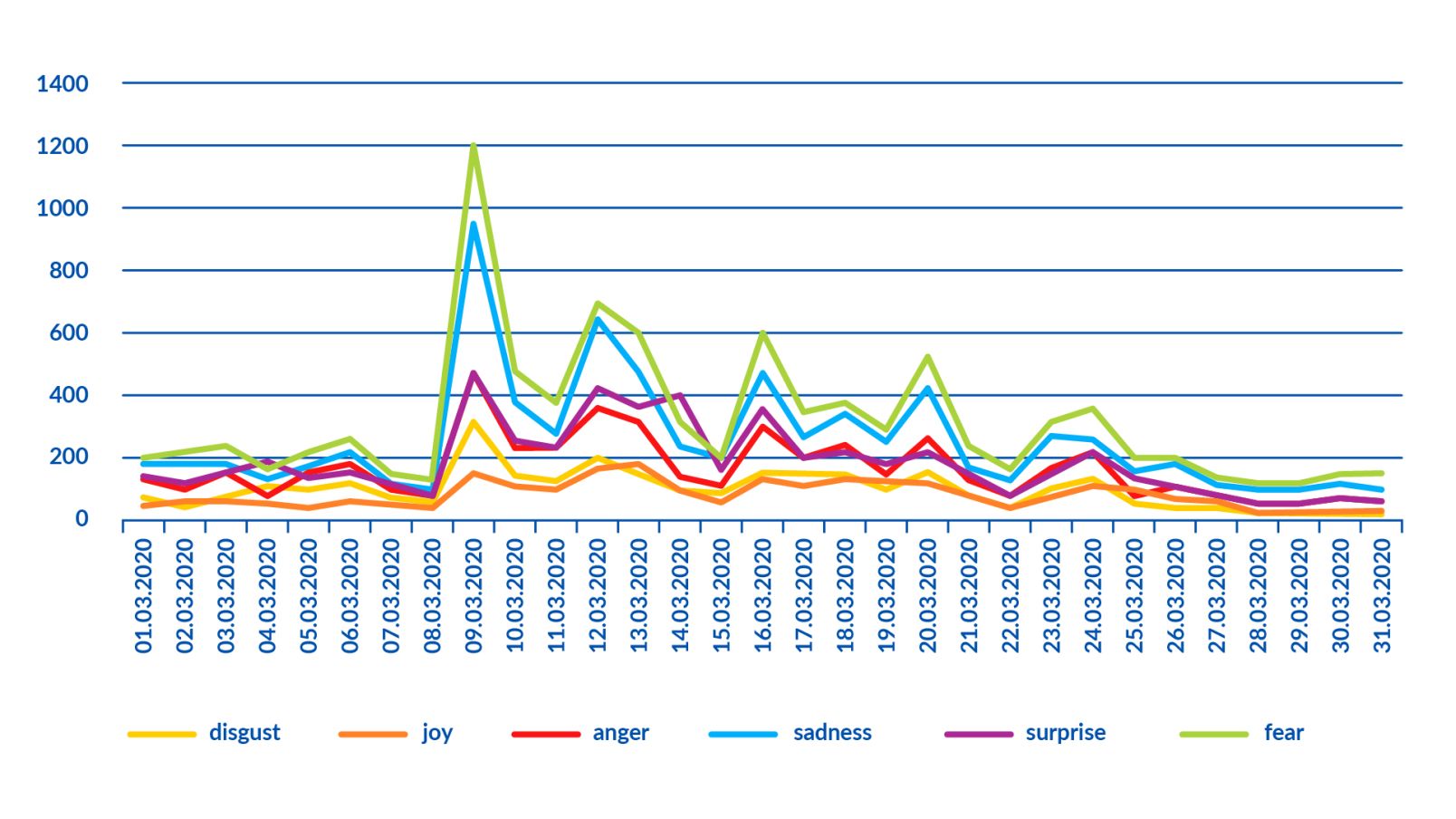

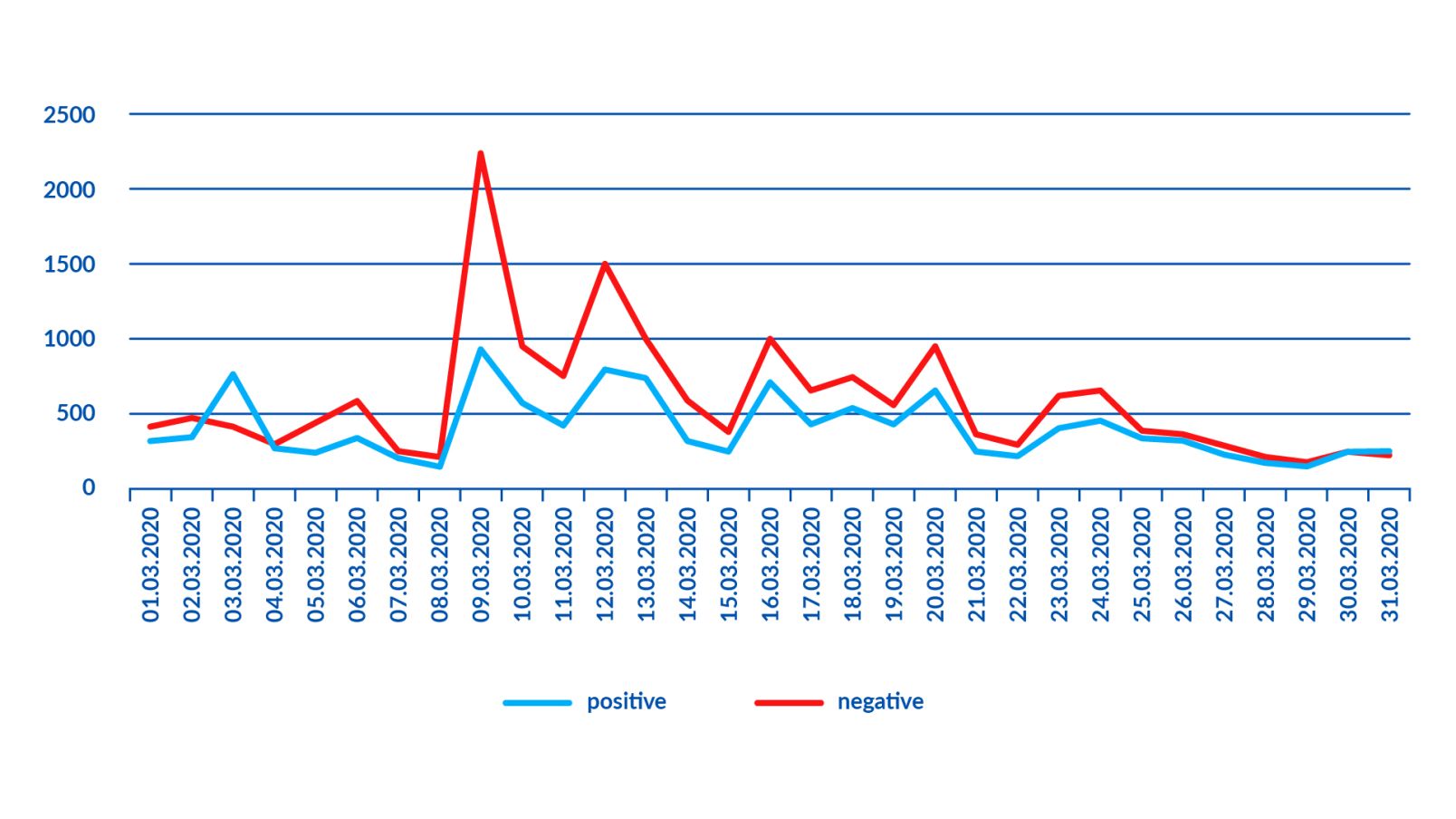

"Briefly speaking, there exist dictionaries containing words that describe particular emotions. Ekman identified six emotions typical of humans: anger, disgust, fear, joy, sadness, and surprise. As analyses showed, in the first stage of the pandemic, investors prevalently experienced fear, and later sadness as well as anger. The only positive word, joy, was listed last. If it had taken a higher position on the list, it would mean there is an estimated 1 per cent of psychopaths in the human population, which is obviously not true," says Prof. Kruszewski. “The higher position of joy on the list would suggest we are happy to have found in a bad situation."

On each day of March 2020 the scientists registered about 20 per cent tweets elated to fear. Internet users sent from 5 to 40 per cent negative messages daily. It does not mean, however, that the positive ones were prevalent," explains mgr Michalak. The rest could be neutral, which means a post involved no word indicating emotions.

Fear as the affect most essential to investors was noticeable throughout the whole March 2020. The researchers did not analyze months that followed because of the black swan attitude towards this issue as investors soon got used to the new pandemic situation. The scientists continued their research till the end of March because restrictions were not introduced at the same time all over the world. Owing to that fact, the market players' reactions were extended in time.

Playing dead

According to the Association of Private Investors (Stowarzyszenie Inwestorów Indywidualnych), despite fear, 43 per cent of investors did not divest loss-making securities. Only 17,8 per cent stock market players decided to sell assets getting cheaper, and 13,8 per cent took the risk and purchased shares heading down.

It all depends on who was analysed - explains mgr Michalak. Someone with huge market experience who professionally deals with market investment obviously showed different reactions than a novice. On the basis of Twitter posts, we were not able to differentiate an experienced player from an occasional one. We treated all of them as hype investors, the ones who react to information published online, in press, on the radio and TV, to the so-called media hype.

The researchers speculate that the above mentioned 43 per cent of investors decided to wait out the first stage of the pandemic. It resulted from lack of benchmarks and inability to foresee how much and how dynamically the situation would develop, which decisions would be made by politicians, authorities, and financial institutions.

Andrzej Romański

“We focused on calculating emotions rather than psychological evaluation of their content." says Prof. Kruszewski. “Survey results well depict a particular aspect of human nature. While endangered, people are determined to perform one of the three reactions: fight, flight, or playing dead. The mentioned 43 per cent chose the last solution developed in the course of evolution: freeze so that you will not be eaten by predators."

The authors emphasize the fact that investors only had eyes for government institutions and decision makers, and it explains why the US President Donald Trump's profiles in social media were so extensively monitored. He appeared in tweets not as an authority but as a decision maker, the head of one of the leading economies, and the one whose activity most affects market.

“If we do not know how to behave, according to the rule of social proof, we often copy the behavior of the group, majority of the group, or our authority." explains Prof. Kruszewski. “Our book shows the image of the 21st century man who does not know where to draw reliable information from and how to distinguish true from fake news. We live in a sort of informational jumble. Everyone can send a post on Facebook or Tweeter, and others have no tools to verify it, to check whether it makes sense or not.

In majority of tweets, no information about geolocation is given. Those examined by the scientists from Toruń were written in English, which indicates users of the Anglo-Saxon background, but not necessarily, as the Chinese, for instance, also use English.

We have at our disposal results of other researchers studying Twitter. They show that the highest user activity has been registered in the US - says mgr Michalak. We have to check which social network is most frequently used in a given country

Rationality

Prof. Kruszewski emphasizes that unemotional investing would be the ideal, but still elusive, option because only then would the stock market players make rational decisions based on analysis and objective estimation. It is, however, difficult as people would have to be fully self-aware, know which criteria they should follow in their lives, which delusions they can be under, which cognitive contents they believe in, etc.

Andrzej Romański

“We are all driven by illusions, schemes, heuristics." claims the cognitivist. “The more self-aware we are, the easier we take control over our limitations. Investments should be planned in a matter-of-fact way, they should be well-calculated.“

“In its mainstream, economics assumes rationality, which means acting unemotionally." says mgr Michalak.

Classical economics assumes that man is rational and makes deliberate decisions, but for many years a lot has been said about the so-called behavioral economics - argues Prof. Kruszewski. More and more frequently researchers state that, making his or her choices, man is driven by irrational aspects, mainly emotions and cognitive contents built upon nonobjective image of reality.

As the economist adds, the pandemic has revealed the fact that there are circumstances which make investors lose the rational attitude. Something that has affected them strongly enough to make them act emotionally emerges. They looked for information on Facebook or Twitter and trusted such sources uncritically.

It is deeply rooted in our human nature that we initially consider each piece of information as true and we believe in it." explains Prof. Kruszewski. “After a while, if we have appropriate and self-tested tools, we are able to evaluate the information. But, at this very first moment, we accept everything we can hear and see. The question is whether we are able to stop and verify the information we have come across or we act affected by the stimulus

Prof. Kruszewski and mgr Michalak cooperate in two research teams which investigate reactions of people observed via Twitter posts. The first team, acting within the scope of Excellence Initiative - Research University Programme (IDUB) focuses its research on emotions of investors. The other one, supported by scientists from Italy, observes public moods related to COVID-19 vaccination.

“Currently, Poland is one of the countries with the highest coronavirus-related death rate per 100 000 people." says the cognitivist. “There is an evident correlation between the number of vaccinations and the decrease in the mortality rate. It would be interesting, but also essential from the civilizational problems point of view, to investigate which information people 'buy' to believe they can be healthy, happy, and safe not being vaccinated at the same time."

NCU News

NCU News

Social sciences

Social sciences